AMENDMENT AND/OR ADDITIONAL INFORMATION TO DISCLOSURE OF INFORMATION TO THE SHAREHOLDERS PT SARIMELATI KENCANA Tbk (The “Companyâ€)

AMENDMENT AND/OR ADDITIONAL INFORMATION TO

DISCLOSURE OF INFORMATION TO THE SHAREHOLDERS

PT SARIMELATI KENCANA Tbk (The “Company”)

.png)

Field of Business:

Engage in Restaurants, Catering, Warehousing, Distribution & Food Processing Industries

Head Office:

Graha Mustika Ratu, 8th Floor

Jl. Jend. Gatot Subroto Kav. 74-75

Jakarta Selatan 12870 – Indonesia

Phone: +62 21 830 6789

Fax: +62 21 830 6790

E-mail: corsec@sarimelatikencana.co.id

Website: www.sarimelatikencana.co.id

This Disclosure of Information to Shareholders is addressed to the Company’s Shareholders in relation to Company’s plan of conducting Management and Employee Stock Ownership Plan (“MESOP Program”) by offering the option right to purchase shares to program’s participants, through issuance of new shares without pre-emptive rights for a maximum of 25,049,263 shares or representing 0.822% of the total issued and fully paid-up capital of the Company.

According to this MESOP Program, the Shareholders of the Company will be subject to a dilution of its ownership of 0.822% up to the completion of the MESOP Program. The dilution estimation is an estimate without taking into consideration the Company’s corporate action in the form of Capital Addition without Pre-Emptive Rights (“PMTHMETD”).

The Company is seeking for approval from the Shareholders in General Meeting of Shareholders to be convened in Jakarta on 24 April 2019.

The Board of Commissioners and the Board of Directors, jointly or severally, are fully held responsible for the completeness and accuracy of entire information and material facts contained herein and hereby confirm that information contained in this Disclosure of Information is accurate and none of unstated material fact can cause material information in this Disclosure of Information become inaccurate and/or misleading.

This Amendment and/or Additional Information to

Disclosure of Information is announced on 15 April 2019

I. REASONS AND PURPOSE OF MESOP PROGRAM

The business activities of the Company are in the fields of Restaurants, Catering, Warehousing, Distribution and Food Processing Industries.

The Company intends to implement sustainable strategies for delivering maximum performance and optimum growth from year to year. In this regard, the Company believes that one of the salient factors to support improvement performance can be achieved due to commitment from management and employee. The MESOP Program is aimed at increasing sense of belonging to the Company, thereby improving the performance of each MESOP Program’s participant, which in turn, will ultimately improve the performance of the Company’s business activities.

The Company hereby announces the corporate action in the form of Capital Addition without Pre-Emptive Rights through MESOP Program by issuing new shares to the participants whereby such new shares shall be issued from the Company’s portfolio in the cumulative amount of 25,049,263 shares having nominal value of Rp.100.- or representing 0.822% of the total issued and fully paid-up capital of the Company.

The cumulative number of issued and paid-up shares of the Company currently consists of 3,021,875,000 shares which shall be used as the basis for percentage calculation of new shares to be issued under MESOP Program. The Company shall perform MESOP Program in compliance with the provisions governed under the Regulation of Financial Services Authority No. 38/POJK.04/2014 dated 29 December 2014 concerning Capital Increases without Pre-Emptive Rights for Public Companies (“POJK 38”).

II. INFORMATION CONCERNING MESOP PROGRAM

The MESOP Program is an offering program of the option right to purchase shares granted to the members of Board of Commissioners, Board of Directors and/or employees of the Company that eligible to own the shares of the Company, which in this case is a subscription of shares by its participants for new shares that would be issued by the Company in the cumulative amount of 25,049,263 shares at the exercise price to be determined by the Board of Directors in compliance with the provisions of Section V of Appendix II of Listing Regulation of the Indonesian Stock Exchange Number I-A Decision Kep-00183/BEI/12-2018 dated 26 December 2018 regarding Amendment to Regulation concerning Stock & Equity Securities Listing in addition to Shares Issued by Listed Company (“Rule I-A”).

The number of shares to be issued under this MESOP Program will be presented for approval before the Shareholders in the upcoming General Meeting of Shareholders to be convened in Jakarta on 24 April 2019.

1. Plan for Utilization of Funds

All proceeds raised from PMTHMETD, after deducting relevant expenditures, shall be fully utilized by the Company for its working capital.

2. MESOP Program Participants

a. Members of the Board of Commissioners of the Company (excluding Independent Commissioner);

b. Members of the Board of Directors of the Company; and

c. Employees of the Company with Grade 7 or above, duly registered in the Company’s employment data who have been working for at least 1 (one) year prior to the date of 30 March 2019, and received appraisal score of average or better during the assessment period of 2018.

Eligible participants of the MESOP Program will be determined by the Board of Directors of the Company.

3. Terms and Conditions of MESOP Program

The MESOP Program will be implemented for a period of 3 (three) years (option life) since the General Meeting of Shareholders dated 24 April 2019. Any share of the Company distributed to MESOP Program’s participants will have a 1-year vesting period. During the vesting period, there will be no participants that could exercise his/her option rights to subscribe the shares. The participants shall be entitled to exercise the option rights during the available window period, which would be opened by the Company once a year. Dividends will not be granted to the shares that have not been issued and subscribed by the participants of the MESOP Program.

4. Exercise Price of Shares

The exercise price of the MESOP Program will be determined by the Board of Directors in compliance with the provisions of calculation governed under the Rule I-A. The Rule I-A stipulates the exercise price of new issued shares shall at least equal to 90% (ninety percent) of the average closing price of the Company’s shares for period of 25 (twenty five) consecutive trading days (“Exercise Price”) before the Company delivers the Letter for Recording of MESOP Program Shares to the Indonesian Stock Exchange (“IDX”).

5. Payment of Exercise Price

The participants shall be obligated to perform payment of the Exercise Price in full and on cash basis during the performance of option right to purchase shares under MESOP Program. The procedure for payment of the Exercise Price shall be facilitated by the Department of Human Resources (HR) of the Company and shall be conducted by means of transferring the funds to the Company’s bank account.

6. Status of MESOP Program Shares

Shares to be issued in connection with the MESOP Program shall have equal right, classification, and degree in all respects with any other fully paid-up shares of the Company, including the right to receive dividend and may issue voting rights in any General Meeting of Shareholders as well as other forms of corporate actions to be undertaken by the Company. All of the issued shares shall be new shares issued from the Company’s portfolio and will be listed on the IDX.

7. Phases for Issuance and Subscription of MESOP Program Shares

The Board of Directors of the Company shall determine the phases for distribution, issuance and subscription of MESOP Program Shares in compliance with the POJK 38 and the Rule I-A. The detailed information of these phases shall be declared when the Company delivers the Letter for Recording of MESOP Program Shares to the IDX.

8. MESOP Program Requirements

a. Company has obtained the approval of General Meeting of Shareholders;

b. Additional Shares Listing Request has been accepted and approved by the IDX;

c. The option right granted under the MESOP Program shall not be assignable or transferable prior to its exercise and subscription by the participants.

d. Any shares under MESOP Program shall be issued directly to the participants.

e. There shall be no restriction for transferring shares by the participants after the exercise of option right to purchase shares.

f. In the event of resignation from the Company and/or termination of employment to any participants of the MESOP Program, then all shares that would be granted, but have yet to be subscribed, shall be forfeited within 3 (three) months since the effective date of resignation and/or termination of employment relationship. The participants of MESOP Program shall no longer have any right to subscribe such shares after the lapse of 3 (three) months period.

g. Other requirements to be determined by the Board of Directors.

9. Management’s Analysis and Discussion

Financial proforma before and after the exercise of PMTHMETD is prepared on the basis of assumptions, as follows:

a. The new shares of the Company that would be issued is in the maximum amount of 25,049,263 shares.

b. The cumulative number of issued and paid-up shares of the Company before the exercise of PMTHMETD as at 28 February 2019 is 3,021,875,000 shares.

c. The cumulative number of issued and paid-up shares of the Company after the exercise of PMTHMETD shall increase into the maximum of 3,046,924,263 shares.

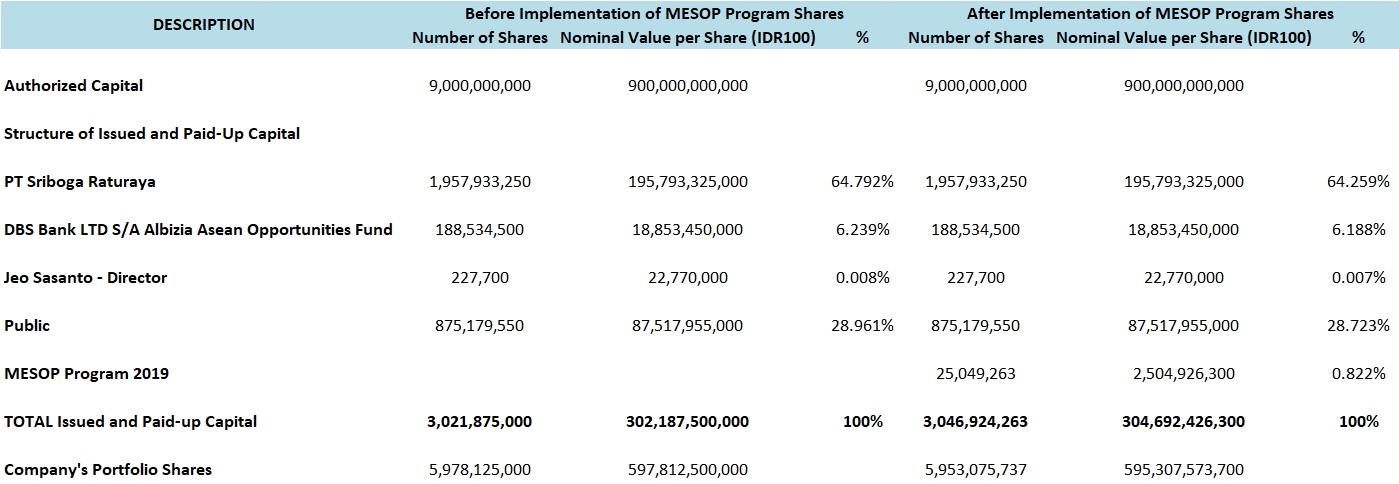

Proforma of Capital and Shareholders of the Company Before and After the Issuance of New Shares in accordance with the Company’s Register of Shareholders as per 28 February 2019

Therefore following the implementation of MESOP Program, the shareholding of the Company’s shareholders shall be diluted by 0.822%.

III. GENERAL MEETING OF SHAREHOLDERS

The Company’s General Meeting of Shareholders for the approval of MESOP Program shall be held in Jakarta, on 24 April 2019. The Company has announced the convention of the General Meeting of Shareholders on 18 March 2019 in Kontan newspaper, IDX website www.idx.co.id and Company’s website www.sarimelatikencana.co.id. The Company has announced the invitation for the General Meeting of Shareholders on 2 April 2019 in Kontan newspaper, IDX website www.idx.co.id and Company’s website www.sarimelatikencana.co.id.

This Disclosure of Information is prepared in compliance with the provisions governed under POJK 38 and the Regulation of Financial Services Authority No. 32/POJK.04/2014 dated 8 December 2014 concerning the Planning and Implementation of General Meeting of Shareholders of Public Company.

Jakarta, 15 April 2019

Board of Directors